The Important Role of Know-how in Applying a Reliable Financial Debt Monitoring Strategy

Significance of Specialist Support

The significance of expert advice in navigating the complexities of debt administration can not be overemphasized. Specialist guidance plays an essential role in developing and performing an effective debt administration strategy. Skilled financial consultants bring a wide range of understanding and experience to the table, making it possible for people and services to make informed decisions concerning their monetary commitments.

Expert advice helps in assessing the current economic circumstance precisely. By examining earnings, costs, and debt levels, specialists can customize a financial debt administration plan that aligns with the customer's monetary capacities and goals (More Discussion Posted Here). In addition, monetary specialists can work out with financial institutions in behalf of their clients, potentially safeguarding lower rates of interest, extended settlement terms, or perhaps financial debt negotiations

Moreover, professional advice instills self-control and liability in the debt administration process. Advisors provide ongoing support and monitoring, guaranteeing that the strategy remains on track and adjustments are made as needed. With experienced guidance, individuals and businesses can browse the complexities of financial debt monitoring with confidence and quality, inevitably leading the way towards financial stability and liberty.

Comprehending Debt Alleviation Options

A comprehensive exploration of sensible financial obligation relief options is essential for companies and individuals looking for to reduce their economic concerns properly. When confronted with overwhelming debt, recognizing the various financial obligation relief options offered is necessary in making notified choices. One usual technique is financial obligation consolidation, which includes integrating multiple financial obligations right into a solitary finance with potentially reduced interest prices. Financial debt negotiation is an additional option where settlements with lenders cause a lowered overall financial debt quantity. For those dealing with extreme monetary challenge, insolvency may be considered as a last resource to get rid of or restructure debts under court guidance. Each of these choices has its ramifications on credit rating, monetary stability, and long-lasting effects, making it important to very carefully consider the benefits and drawbacks prior to proceeding. Seeking recommendations from economic experts or credit history therapists can provide important understandings into which financial obligation relief option aligns ideal with one's special financial situation and objectives. More Discussion Posted Here. Inevitably, a knowledgeable choice concerning debt alleviation options can lead the way towards a more protected and secure financial future.

Negotiating With Creditors Successfully

Checking out efficient arrangement methods with financial institutions is paramount for people and services navigating their financial obligation alleviation choices. When negotiating with financial institutions, it is critical to come close to the discussion with a clear understanding of your financial he has a good point situation, including your revenue, costs, and the quantity of financial obligation owed. Openness is key during these conversations, as it helps construct depend on and reliability with creditors.

One efficient method is to propose a structured repayment plan that is sensible and manageable based upon your current financial capacities. This shows your commitment to fulfilling your responsibilities while additionally acknowledging the challenges you may be facing. In addition, offering a round figure negotiation or asking for a reduced rates of interest can likewise be practical settlement methods.

In addition, remaining tranquility, considerate, and expert throughout the arrangement process can dramatically enhance the possibility of reaching an equally advantageous arrangement. It is crucial to document all communication with creditors, consisting of contracts gotten to, to prevent any misunderstandings in the future. By employing these negotiation methods, businesses and people can work in the direction of settling their debts efficiently and sensibly.

Customized Financial Obligation Monitoring Strategies

In creating reliable financial obligation management methods, customizing the approach to match the one-of-a-kind economic situations of companies and individuals is crucial. Custom-made financial obligation administration approaches entail a customized analysis of the borrower's financial situation, taking into account variables such as revenue, expenses, impressive debts, and future economic objectives. By tailoring the financial debt administration plan, professionals can produce a customized roadmap that addresses the details requirements and difficulties of each customer.

One secret aspect of tailored financial debt management strategies is the growth of practical and possible repayment strategies. These plans are structured based on the person's or company's financial capacities, making sure that they can satisfy their commitments without triggering undue economic stress. Additionally, personalized techniques might entail discussing with lenders to secure a lot more beneficial terms, such as reduced rates of interest or extended repayment durations, better easing the burden on the borrower.

Tracking and Readjusting the Plan

Effective financial obligation administration experts comprehend the significance of constantly keeping track of and changing the tailored payment plan to guarantee its efficiency and alignment with the customer's financial conditions. Monitoring entails regularly tracking the progression of the financial obligation monitoring plan, reviewing the client's adherence to the agreed-upon settlement schedule, and recognizing any variances or barriers that why not look here may emerge. By constantly keeping an eye on the plan, specialists can proactively resolve problems, provide needed support, and stop potential problems.

Regular interaction in between the financial obligation administration professional and the customer is essential throughout the tracking and adjusting process. Open up dialogue enables transparent conversations concerning any kind of obstacles or adjustments, enabling both celebrations to function with each other effectively towards the client's economic objectives.

Verdict

In final thought, knowledge plays an essential duty in carrying out an efficient debt management strategy. Customized financial debt monitoring techniques are essential for producing a plan customized to each redirected here person's demands.

By analyzing income, costs, and financial obligation degrees, professionals can customize a financial obligation management plan that aligns with the customer's financial capacities and goals. When encountered with frustrating financial debt, understanding the numerous debt alleviation alternatives available is crucial in making informed decisions. One usual method is financial obligation loan consolidation, which involves combining several financial obligations right into a solitary loan with possibly reduced passion rates. Financial obligation settlement is one more choice where settlements with financial institutions result in a lowered general debt quantity. Customized financial obligation management strategies entail a tailored evaluation of the debtor's economic scenario, taking into account factors such as revenue, costs, superior financial obligations, and future monetary goals.

Danny Tamberelli Then & Now!

Danny Tamberelli Then & Now! Danica McKellar Then & Now!

Danica McKellar Then & Now! Marcus Jordan Then & Now!

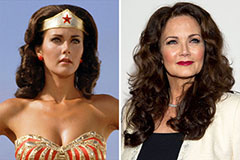

Marcus Jordan Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Ricky Schroder Then & Now!

Ricky Schroder Then & Now!